Professionals are also required to disclose business codes. Income by way of long term capital gains.

Payslip Template Free Word Templates

Supplier and recipient are both not body corporate forward charge mechanism is applicable.

. Supplier is not a body corporate but the recipient is reverse charge mechanism is applicable. GST applicable 5. You are adviced to double check rates with GST rate book.

You have to only type name or few words or products and our server will search details for you. HSN Code and GST Tax rate for Works of art collectors pieces and antiques under. Taxes to be subsumed under GST are Excise Duty Service Tax Central Sales Tax Surcharge Fees VAT Taxes on Lottery Luxury.

What Are the GST Codes Terms. Capital acquisition GST free item. View All Popular Posts.

In case any Income is subject to tax at special rates based on any DTAA then this code has to be selected and rate of 1 has to be selected. Various business Codes for ITR forms for AY. Goods Services Tax GST Login.

GSTIN code represents origin state PAN number and nature of business etc. PLEASE REFER ADVISORY 162022 DATED 030822 REGARDING ACCOUNTING HEAD CODE TO BE USED FOR PETROLEUM CRUDE AND AVIATION TURBINE FUEL FOR PAYMENT OF SAED Functionalities for appeal proceedings for Taxpayer appeal APL-01 and Tax Department. But many business owners choose to do so anyway so that they can benefit from a number of different forms of tax relief.

Tax rates are sourced from GST website and are updated from time to time. Serial number and date. HSN Code and GST Tax rate for Project imports Laboratory chemicals passengers baggage personal importation by air or post.

A committee to review the levy on restaurants. Goods Services Tax GST Payment. GST on Salary.

Renting of motor vehicles. Merchant exporters need to pay 01 tax on domestic goods procurement. Income tax due dates.

Supplier is a body corporate Forward charge applicable. Goods and Services Tax. This code displayed on the registration certificate is referred to as the Goods and Services Tax Identification Number GSTIN.

Gst sac codes. View form 26 as. HSN or SAC codes if required.

10 Crores wef 01102022. Total taxable value of supply. Join our Courses on GST Customs Excel.

Here is a list of GST codes and terms that comply with the Australian BAS. Gst word full forms. 18 GST on salary paid for services by a firm to its branch offices in other states rules AAR - The Economic Times Business News News Economy Policy 18 GST on salary paid for services by a firm to its branch offices in other states rules AAR ED freezes crypto exchange WazirX directors bank accounts.

Income Tax department specified Business codes for ITR Forms for AY 2021-22. Strips the Like of synthetic textile material must not have more than 5 mm of apparent width. The Central Board of Indirect Taxes and Customs CBIC has notified that 18 Goods and Services Tax GST rate will be applicable 1 J 1 January 2022 onwards and f the 12 GST rate for government contracts will be withdrawn.

Know your pan status. E-way bill to be rolled out from 1 April 2018. GST Tax Slab Rates List 2021.

HSN code for Works of art pieces antique ch-97. Name address and GSTIN of supplier and recipient. Goods and services having 18 12 5 GST slab rates came down to Nil for many of the products.

Appropriate income and tax has to be entered by taxpayer in this Schedule. GST rates for all HS codes. Name and address of recipient if not registered.

Taxpayersbusinesses registered under the GST would receive a 15-digit alphanumeric unique identification code. A Goods and Service Tax GST invoice shall clearly disclose the following. Ship stores under section-21 chapter-98 If the traders trades for Project imports July 10 2020.

Link aadhar to pan. KIND ATTENTION OF CENTRAL EXCISE PETROLEUM SECTOR TAXPAYERS. We can still file Income Tax Return for FY 2021-22 AY 2022-23 GST E-invoice limit reduced to Rs.

Description of goods and services. AGRICULTURE ANIMAL HUSBANDRY FORESTRY. GST CODE REFERENCE GUIDE 4 3.

Statutory Tax Compliance Tracker for August 2022. 5 12 18 and 28. Type of Supply GST code Taxable supplies 10 GST C GST-free supplies 0 GST F Out-of-scope supply 0 GST NA.

Capital acquisition GST item. GST Tax Rates revisions Revision all big recent revisions 28 th GST Council meeting held on July 21 st 2018 came up with number of revisions regarding the GST slab rateThis included GST rates deductions on 28 slabs which came down to 18 and 12. 67 Decitex of Synthetic Monofilament or more than it no cross-sectional dimension of this filament is over 1 mm.

You can search GST tax rate for all products in this search box. 2020-21 mentioned below-BUSINESS CODES FOR ITR FORMS FOR AY 202122. Grievance against Payment GST PMT-07.

GST Code Detailed Reference Guide 31 Supplies SalesIncome - Summary of Transactions and GST Impacts The GST treatment GST Code will depend on the type of supply made as outlined below.

Watch This Video Here Http Www Youtube Com Watch V Wsvfcomdrcq Fast Track Income Salary

Simple Invoice Template Microsoft Word

What Is The Difference Between Gst And Income Tax Quora

Must Know Important Things On Gst Payment For Freelancers Freelance Goods And Service Tax Payment

How To Pay Business Taxes In Canada

Gst On Salaries A New Ruling Can Cause A Lot Of Confusion And Litigation Business Insider India

Income Tax Return Form For Ay 2019 20 Fy 2018 19

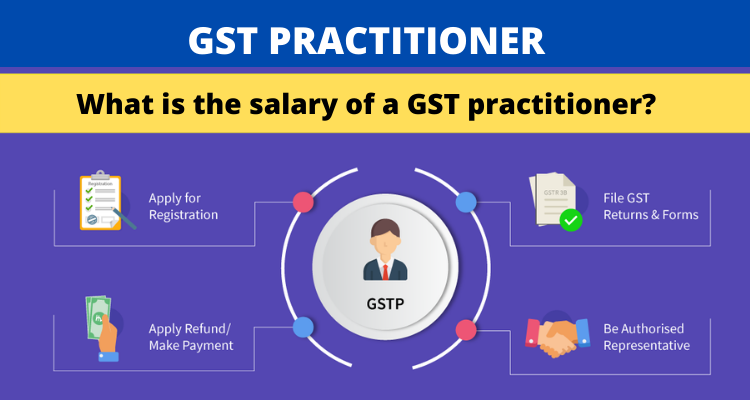

What Is The Salary Of A Gst Practitioner Vskills Blog

Tax Taxaudit Gst Lastdate Incometax Penalties Refund Returns Income Tax Capital Gain Business Law

Gst Invoice Format In Excel Word Pdf And Jpeg Format No 7

Best Effective Ways To Deal With Tax Free Salary Taxreturnwala

Aiat Gst Suvidha Kendra Income Tax Return Income Tax Return Filing Income Tax

Tax Invoice Template Free Word Templates

Gst Billing System With Full Project Source Code